Payment Card Industry - Data Security Standard (PCI-DSS) Compliance

We also have a very strong audit and compliance practice in PCI-DSS. The following will give you some highlights of PCI-DSS.

About PCI DSS

PCI DSS was created by the Payment Card Industry Security Standards Council. The council comprises of MasterCard, Visa Inc., American Express, Discover Financial Services and JCB International.

- Increased credit card fraud led to the establishment of mandatory Data Security Standard to prevent theft of personal card holder’s information.

- The standard applies to merchants or service providers that transmit processes and or stores credit card information.

Our PCI Service delivery

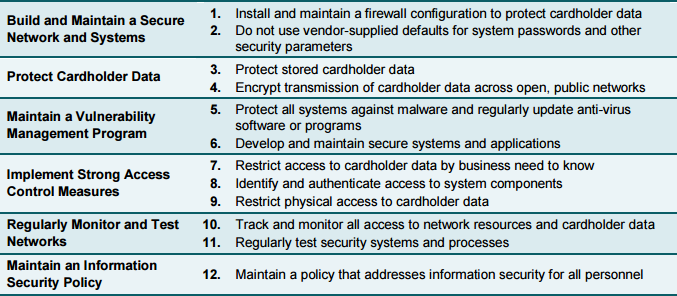

Readiness audit to ensure the following:

- Scope are identified

- Review of network topology for appropriate segmentation

- Conduct PCI DSS requirement audit to test and identify areas of non-compliance

- Collaborate with process owners to ensure adequate remediation

- Collaborate with QSA to ensure needed compliance evidence was provided to validate compliance

- Etc.

The above covers the 12 elements of PCI DSS requirements

Consequences of non PCI compliance

- Forensic investigation

- Revocation of credit card business privileges

- Steep monetary fines (up to $500K) levied by the card associations plus damages on acquirer that may be transferred to merchants/service providers

- Lawsuits

- Damage to reputation

- Bad publicity